Wow! New Highs. Does it make sense? - Updates and Commentary by Howard Isaacson

- Feb 16, 2015

- 5 min read

Not surprisingly, we hit new highs this week in some stock market indexes and the Nasdaq hit its highest point in the last 15 years! A few major items drove the markets higher this past week included:

generally solid earnings reports,

a ceasefire agreement between Russia and Ukraine,

Greece – EU discussions ongoing without any “door slamming”,

mixed economic news in the US,

strengthening oil prices, and

a temporary cease to the appreciation of the US Dollar.

The S&P 500 ended the week at 2097, up from 2055.47 last Friday, for a 2% move over the week, and closed at an all time high.

Source: www.Marketwatch.com

The yield on the US 10 year Treasury, continued to move higher to 2.05% from a 52 week low 1.64% two Fridays back and 1.96% last Friday:

Source: www.Marketwatch.com

The German 10 Year Government Bond yield moved quite a bit this week, ending at 0.31% from 0.34% last week.

Source: www.Marketwatch.com

The Euro moved a bit higher during the week, ending the week at 1.139 from 1.131 last Friday.

Source: www.Marketwatch.com

Crude oil continued to demonstrate the strength it showed last week, after having hit new lows two weeks back:

Source: www.Marketwatch.com

In the face of very, very cold temperatures in the North East, natural gas prices finally showed a bit of strength and moved higher to $2.804 from to $2.579 MBtu from last Friday:

The above is the price of natural gas futures at the national level. Below is a list of current spot prices as of yesterday. Note, the Percentage Change is from the DAY before. (Thanks for the positive comments regarding the inclusion of this chart.) (I added the “Last Friday” column as I think it is very helpful.)

An now for some of the economic facts and stats from this past week:

Consumer Sentiment actually came down to 93.6 from a prior reading of 98.1. This remains a strong number, but it does not demonstrate the exuberance of the prior figure. Similar findings were also for the Index of Current Economic Conditions and the Indiex of Consumer Expectations. All three were lower than the prior month by 3.8-5.7%, but higher than prior year’s figures by 8.1-20.4%. http://www.sca.isr.umich.edu/

Both the price of imports and the price of exports contracted this past month, demonstrating that the risk of deflation is VERY real. Export prices were down y/y by 5.4% in the face of the appreciated USD. Import prices Y/Y were down 8.0% (reflecting appreciation of the USD and the decline in energy prices). Month over month, both were down 2.0% and 2.8%, respectively.

Source: Bloomberg.com

Jobless claims rose from 278k to 304k, significantly worse than the consensus. The four week average continued to tick lower. http://www.dol.gov/ui/data.pdf

Retail sales were 0.8% lower from prior month, due to declines in sales of autos and the price of gas. Without these two sectors, retail sales were up 0.2%. Year over year, total retail sales were up 3.3%, including all sectors. http://www.census.gov/retail/marts/www/marts_current.pdf Analysts expressed disappointment with these figures, as some believed that the savings from reduced energy costs are being “saved” rather than spent….. It may be that folks are waiting for spring to spend…..

Small business optimism came in at 97.9, down from 100.4 in December. Though this was down, it is still a very positive figure. Very strong positives are the number of current job openings and the inventory levels, which are considered “too low”; both of which are considered very optimistic factors. Regarding inflation, only 3% reported that they expect to raise selling prices. http://www.nfib.com/surveys/small-business-economic-trends/

The JOLTS report – Job Openings and Labor Turnover Survey from the Labor Dept, showed 5.028 million job openings, up from 4.972m last month. There were also 5.148m hires and 4.886 separations in the month. The increasing number of openings and the spread between hires and separations are both positives.

Earnings Update: With 391 of the 500 S&P 500 companies reporting, 77% reported above their expected earnings with 58% reporting revenues above expected figures. The financial and operational successes of these companies has helped propel the markets higher. http://www.factset.com/websitefiles/PDFs/earningsinsight/earningsinsight_2.13.15

Some readers follow closely the natural gas prices. Thus, it is worth noting that US Natural Gas inventories declined by 160 billion cubic feet in the past week (i.e., demand exceeding supply). With this week’s decline, total inventories are now 11 Bcf below their five year average. http://ir.eia.gov/ngs/ngs.html This may be helpful in providing support to Nat Gas prices.

Crude oil inventories, though, are continuing to move higher…. Adding 4.9 million barrels during the week, even though import levels were lower. http://www.eia.gov/petroleum/supply/weekly/pdf/highlights.pdf

Some other relevant info:

A look at the current run up:

Here is a chart of the Nasdaq for the past 20 years. It is amazing that it has taken 15+ years to revisit the highs. (We are almost there….)

Parabolic curves are typically signs of “danger ahead”. At the same time, the key of course is valuation…..

As you can see on the bottom of this graphic, the trailing P/E is less than 20% of what it had been the last time we were at these levels (i.e., last time we were more than 5x more expensive.)

Q4 earnings growth for Technology companies was 9.6% vs 3.1% for the S&P 500 overall. Thus, providing support for the current valuations….. http://www.factset.com/websitefiles/PDFs/earningsinsight/earningsinsight_2.13.15

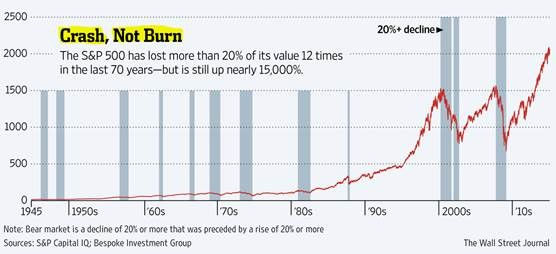

A Look At Bear Markets:

Notice that each time the market went into a Bear Market (20% decline after a 20+% rise), it rebounded over time.

I love the phrase: “The highs get higher and the lows get higher” over time.

Thoughts and commentary:

Last year’s winter season coincided with an economic slowdown in GDP. Whether it was all due to weather or only a small bit, is subject to ongoing debate. With the tons of snow occurring in the NE combined with sub zero temperatures in much of the North, there very likely can be economic repercussions. As the same time, there is a work slowdown on the West Coast docks which is absolutely having a profound impact on the flow of imports and exports, as well as increasing the cost of importing goods. Trains and trucks moving product are also being impacted, as well as shelves of retailers. This will certainly show up in economic numbers, but the extent is unknown at this point in time.

After such a strong 4th Q, many companies are pre-announcing reduced guidance for 1st Q 2015. The market has been taking these in stride overall, while punishing the specific companies.

Refinancing of corporate balance sheets is continuing with extremely large issuances by US companies in multiple currencies. This has the effect of reducing their long term cost of capital, which is beneficial to shareholders.

When the Fed will raise rates is of course uncertain to all but the Fed members. Many are speculating that it will occur in June, the Summer, or Fall. We are prepared regardless and the timing will not impact our investment models for fixed income or for equities. So we will sit and watch the speculation on the rate increases and wait patiently.

As always, even as the market hits new highs, there are opportunities. Innovation in technology, medicine, service delivery, and in manufacturing will help to drive the economy forward. Lower energy prices in natural gas and oil and gasoline will help bolster corporate bottom lines and household checking accounts. Regardless of whether the savings are saved or spent, the fact that the US Dollars are staying in the US rather than going to the Middle East is certainly a good thing and the US will benefit from this shift over time!

Wild cards over the coming days and weeks will focus on Greece and their bailout discussions with the EU, the cease-fire in Ukraine, continued corporate earnings, ISIS and other terrorist activities, and the US economy.

Thank you for reading this. Please reach out with any questions or comments, and feel free to share this email.

Have a great week!

Comments