Up, up, up go the markets......

- Dec 7, 2014

- 5 min read

Friday was a busy day and I was unable to spend the time to draft my weekly notes. Hence, below is an abbreviated weekly note, with some key happenings for this past week and some thoughts as we move forward…. As always, thank you for reading!

Oil was the main headline over the past few weeks, and it continued this week in the US and abroad. Oil continued to drift lower as the week drew to a close, offsetting some (very short term) optimism that pricing may have bottomed. Clearly, it is likely we are not there yet. WTI Crude moved to $65.84 from $66.15 last week. http://www.nasdaq.com/markets/crude-oil.aspx?timeframe=7d

Wildcards impacting the market’s perceptions of demand include the strength of weakness of the global economies (esp. Europe, China and Japan) and the impact of newer, more efficient vehicles replacing older vehicles here in the US. On the supply side, we have the potential lifting of sanctions against Iran, which could add 2 million barrels daily to supply, continued unrest in parts of the Middle East and the impact of lower prices on US production and investment. Anyone who tells us with confidence they know where the prices are going is ……….

Last week, we touched on the fact that the Natural Gas market and the Oil markets are very different, and they each have numerous different factors impacting prices. Hence, from an investment perspective, esp. here in the US, we must look at the two industries separately.

Here, though, is a chart of the ‘Natural Gas’ Spot Prices and next to it a chart of the ‘Natural Gas Liquids’ Spot Prices. Very Interesting….. and another layer of complexity, esp. since October, as per the chart.

Okay, let us raise our focus from the energy trees to the greater macro environment:

Once again, the markets hit new highs during the week and ended the week a bit higher than last Friday. S&P 500 and Dow 30 indices, to 2075 from 2068 last Friday and to 17859 from 17828, respectively. The ten year T yield rose to 2.31% from 2.17% one week back and close to where it was two weeks back at 2.32%, as the UK and Germany’s rates ticked a bit higher but Italy, Spain and Japan’s rates continued lower. http://www.marketwatch.com/

Key drivers this past week:

WSJ – “Hiring grows at best pace since 1999” http://www.wsj.com/articles/u-s-payrolls-in-november-grew-321-000-jobless-rate-5-8-1417786322?mod=WSJ_hp_LEFTWhatsNewsCollection

Average hourly earnings moved higher: http://news.investors.com/PhotoPopup.aspx?id=729296&docId=729356

New Jobless Claims Fell: http://news.investors.com/economy/120414-729082-new-jobless-claims-fall-to-297000-last-week.htm

The European Central Bank cut its outlook for Europe and ECB President Draghi indicated that if needed the ECB make policy directives and take actions “altering early next year the size, pace and composition of our measures.” http://www.bloomberg.com/news/2014-12-04/draghi-says-ecb-will-reassess-stimulus-measures-early-next-year.html The ECB is clearly confounded by the benefits of the lower costs of energy to European companies and households, offset by the detraction of growing deflation fears as reduced energy prices filter through on costs and pricing.

Announced company layoffs fell to 35,950 for November 2014, from 51,183 in October 2014 and 45,314 for November 2013. http://www.challengergray.com/press/press-releases

A few other factual points to make note of:

Projections of the National Housing Market from the National Association of Realtors: http://www.realtor.org/presentations/presentation-residential-real-estate-trends-and-outlook

All -cash sales of real estate account for 33.9% of residential transactions nationwide and more than 50% in most larger Florida markets. http://www.realtytrac.com/content/foreclosure-market-report/us-institutional-investors-and-cash-sales-report-q3-2014-8179

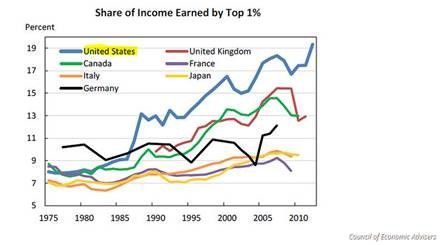

For those that I have spoken with recently about structural and systemic risk to the US some time in the future, the following chart is an excellent illustration of what I consider to be a growing risk:

I do not think systemic risk is imminent, though it is imperative to be aware of this trend from an investment and business development perspective.

Roubini’s Mother of All Asset Bubbles. Here is a link to his latest recorded interview from this week: http://finance.yahoo.com/news/roubini--u-s--equities-will-be-strong-until-2016-133934757.html Summary, he does not expect any bursts next year. He expects markets to continue to be stretched and to further their movements and in few years we would see the bubble pop…. His premise is that all this liquidity will cause asset inflation and that inflation will bubble and then pop…. Fortunately, nothing is imminent. He expects another leg down in commodities, and further strength in the USD. (Dr. Roubini is a renowned economist who teaches at NYU. He is very well respected and has held numerous positions at Ivy League universities, international economic agencies, and various Presidential administrations.)

There is no technical definition for “bubble”, but it is generally accepted that it reflects an unsustainable growing valuation, which at some point in time reverts downward in a fast manner.

The real estate bubble and the credit bubbles that imploded between 2007 and 2009, as well as the dot-com bubble of 1997-1999 are excellent examples from the past. Excessive funds flowed into these sectors, creating unstainable valuations based on assumptions, that we they did not come about, causing liquidity issues and collapsing prices investors tried to sell and few buyers appeared to purchase at inflated prices.

We have seen what I consider to be “micro bubbles” appear and burst successfully over the past 18 months without grave harm to the markets or its systems. The following are just a few off the top of my head. We have experienced them and the markets and stock prices overall move higher…..

The morning of October 15, 2014 may have experienced a popping of a bubble. http://blog.themistrading.com/what-happened-in-the-us-government-bond-market-on-the-morning-of-october-15th/

The rise and decline in prices of several 3D printing companies can be considered a micro bubble. http://finance.yahoo.com/news/3-d-printing-bubble-already-104916841.html

Cloud computing earlier this year. http://www.bvp.com/blog/cloud-stocks-fall-26-6-weeks-bubble-bursting-or-buying-opportunity

Emerging oil and gas exploration companies. http://etfdb.com/index/sp-smallcap-600-energy-index/#returns

Gold http://www.ft.com/intl/cms/s/0/87b51cf2-60f9-11e4-b935-00144feabdc0.html#axzz3LFV769Dg

I have included the “cash sales” percentages for residential real estate above, as this environment is very different from that of the real estate boom of 2004-2007 which was fueled by banks and lenders and the images of ever increasing prices. Here is a great link to Zillow’s valuation index versus trend… Very interesting when looking at individual markets. http://www.zillow.com/research/zillow-home-value-appreciation-5235/

As trusted advisors to our clients, we are constantly on the lookout for bubbles and the inherent risks. Yes, equities are no longer inexpensive. (There are numerous ways to value a company, but one of the accepted standards is using the Present Value of Future Cash Flows. In the calculation, the future cash flows are discounted using a “discount rate” which is a form of an interest rate and is in the denominator of the formula. Thus, if the discount rate/interest rate goes down and the numerator is the same, then the numerical present value increases.) Current equity values reflect the current interest rate environment. As interest rates do rise, there is definitely a risk that the “discount rate” used to calculate values does increase. Without an increase in the numerator, the current values/market values can go down. Thus, we are constantly looking for growth and reaffirming our estimates and projections and research.

The weeks between now and year end will likely include a bit of volatility and inconsistencies as institutional investors rebalance portfolios for tax purposes as well as for year-end cut off appearance sakes (a.k.a. “window dressing”).

We remain optimistic about 2015, though an increase in interest rates will cause a bit of trembling within the stock market as well as in the bond market. We are working hard to take advantage of these opportunities and to minimize the threats.

Please reach out with any questions, at any time.

Have a great week!

Comments